"An Attorney near me" - Cape Town legal directory

lawyer@capetownlawyer.co.za or WhatsApp

Select your suburb using the dropdown menu above and our customised tool will show you the best estate planning attorney in the area.

Best Estate Planning Lawyers in Cape Town

It's really expensive to die in South Africa! Costs incurred include the likes of executor fees, estate duty and transfer costs - and you're not around anymore to negotiate these down!

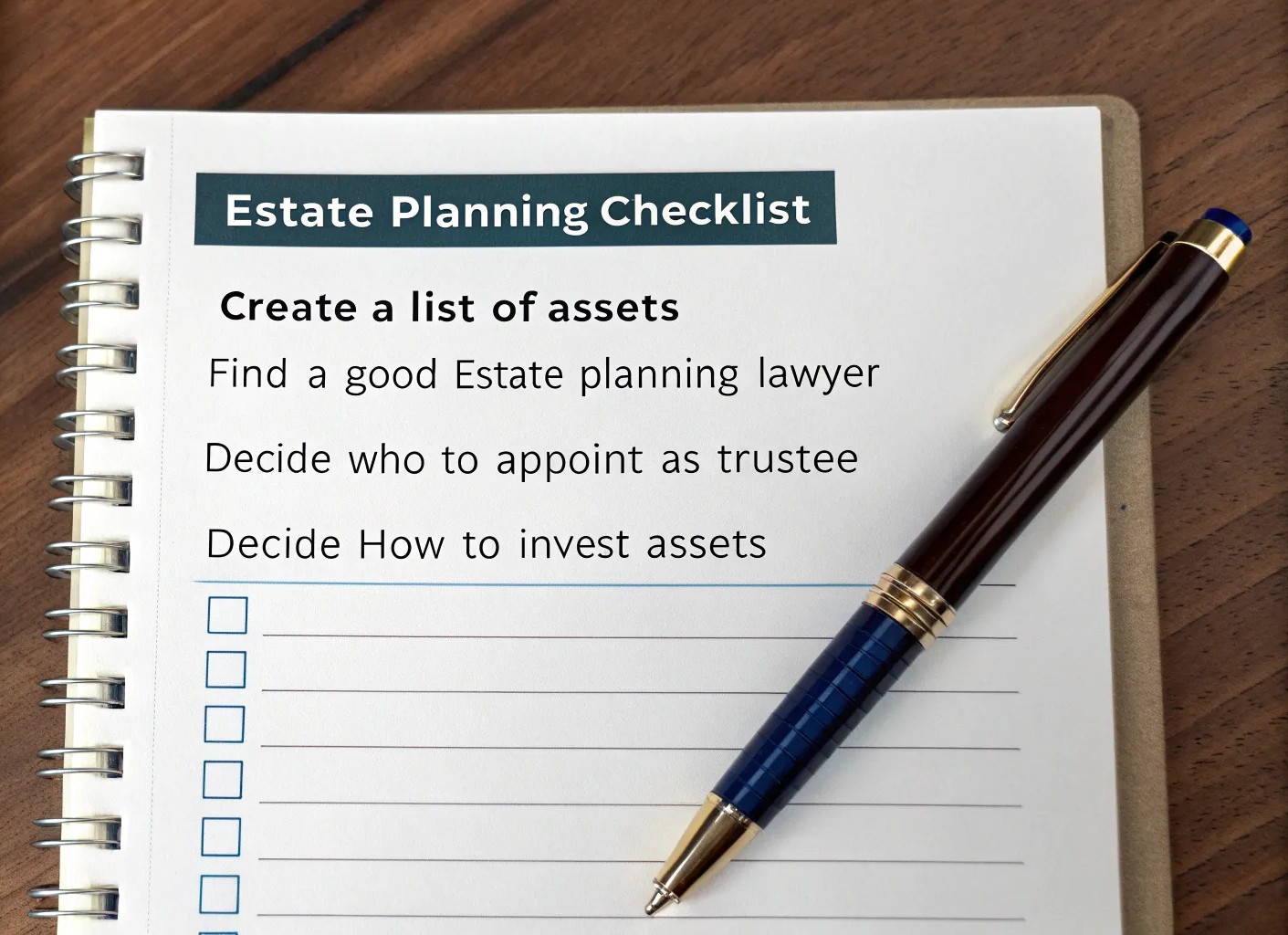

Estate planning is essential for protecting your wealth and securing your family’s future; it ensures that your wishes are respected after you've gone and may help minimise estate duty. To help you find the right legal expert for your needs, we’ve curated a list of the top lawyers in Cape Town who specialize in wills, trusts, tax planning, and executorship of deceased estates. They can help you with:

- Registering a trust and reviewing of existing trusts.

- Ensuring that the beneficiaries on all your policies and accounts are up to date.

- Drafting a last will and testament, and/or reviewing an existing will to reflect your current wishes.

Need further assistance? Email us for a personalised recommendation

This is not intended to be an exhaustive directory; but inclusion on this page does not constitute an endorsement; readers should conduct their own due diligence before choosing a lawyer. The order of appearance in the list has no meaning. Contact the attorneys directly for consultations.

- Name: Clare Wendy Faria

- Firm: Cloete, Baker & Partners

- Phone : +27-21-4244300

- Location

City Centre (Cape Town CBD)

- Online Appointments: Yes

- Qualifications :

- 2006 : LLB

- 2008 : Admitted Attorney, Notary and conveyancer

- Areas of Practice: Wills, Trusts, Deceased Estate Administration, Executorships, Transfers of inherited property

- Google Business rating: ***** (Cloete, Baker and Partners rating)

- HelloPeter rating: .Not rated

- Name: Natalie Macdonald-Spence

- Firm: Spence Attorneys, Notaries & Conveyancers

- Phone : +27-21-5329224

- Location Pinelands, Cape Town

- Online Appointments: Yes

- Qualifications :

- 2016 :Bachelor of Law

- 2018 : Right of Appearance - High Court of SA

- 2019 : LLM in Tax Law (UCT) :

- 2022 : Solicitor of England and Wales

- Conveyancer & Notary Public

- Areas of Practice: Wills, Estates, Conveyancing, Notarial Services, Family Law. .

- Google Business rating: ***** (Spence Attorneys, Notaries & Conveyancers' rating)

- HelloPeter rating: .Not rated

There is a great deal of subjectivity involved in compiling this list and others would arrive at different answers; It is critical that you carry out your own due diligence of any estate attorney before selecting one. Treat the list above as merely being a started point, and fully scrutinise the estate lawyers before you select one.

Estate planning services:

- Drafting last will and testament; and review thereof (this can be a completely online service, for those who prefer that)..

- Trust formation and administration

- Deceased Estate administration and executorship

- Power of attorney and the notarial authentication thereof

- Living wills/advance directives

- Guardianship for minor children

- Tax planning related to estates

- consideration of settingup a trust

- consideration of donations vs inheritance

- consideration of property inheritance via a usufruct

Criteria used to compare attorneys

- Years of Experience: Specifically in estate planning.

- Qualifications: LL.B, LL.M, specialised certifications (e.g., Certified Financial Planner, Trust and Estate Practitioner).

- Professional Memberships: Membership in relevant organizations (e.g., Fiduciary Institute of Southern Africa (FISA), STEP South Africa).

- Areas of Specialisation: Do they specialize in complex estates, offshore trusts, business succession planning, etc.?

- Reputation: Online reviews, peer reviews, awards, recognition in legal publications; ratings by other parties; such as HElloPeter or Google Businesses.

- Client Testimonials: If available and verifiable.

- Published Articles/Speaking Engagements: Demonstrates expertise and thought leadership.

Estate liquidity

A common mistake is to not have sufficient liquid assets to meet all the estate's liquidity needs; e.g. property transfer costs applicable to a deceased estate (even if the property is inherited and there's no transfer duty payable, there are other applicable transfer costs), estate duty, capital gains tax, outstanding debt and Master’s fees.

Taxation of Deceased Estates

A deceased estate is subject to capital gains tax as well as estate duty. Estate duty is applied against what SARS call the "dutiable value" of the estate; which equals its net assets less an abatement (R3.5m ;at the time of writing). Estate duty is levied at:

- 20% on the first R30m of dutiable value

- 25% on the excess of the dutiable value over R30m

Capital Gains Tax is levied on any asset in the deceased estate which the executor sells, at the same inclusion rate for CGT applicable to natural taxpayers; with the following deductions/exemptions:

- No CGT on property inherited by a surviving spouse. Roll-over of capital gains will apply; so when the surviving spouse sells the property all the gains made will count for CGT.. •

- Gains on the disposal of a primary residence, to the extent that the gains are not in excess of R2m. . •

- An exclusion on the sale of personal use assets.

Estate Duty

- 1988. Estate duty is changed from being at a tiered and progressive rate to a flat rate.

- 1955. The Death Duty Act of 1922 is replaced by the Estate Duty Act 45 of 1955.

- 1922. Death Duty Act 29 of 1922 comes into force.

Leaving a single asset to multiple heirs

Sometimes a property, is left to several heirs; whilst this may come with the btest intentions, it often leads to disagreements, one beneficiary may want to live in the house, another may want to rent it out, whiilst a third may wish to sell the property.

Forced heirship

Certain European countries have forced heirship laws, where you must leave some of yoru estate to your children. If applicable, you may want to have a seperate will drafted in the local jurisdiction specifically for countries like France, Portugal and Spain.

Family, Estate & notarial legal services

Deceased Estate Information

If a relative has died, perhaps without a will, and you are unsure of what do:

- Report deceased estate to the Master online

- Steps to take when your parent dies without a will.

- Lawyers in Cape Town specialising in deceased estates.

- Administrators in Cape Town for deceased estates .

- Letter of executorship requirements in South Africa.

- J192 form - next-of-kin (if no will)

- Nomination to act as executor (if no will)

- J190 form assistance

- Administration of deceased estates in South Africa.

- Property transfer cost in a deceased estate.

- Inheritance and child maintenance obligations.

- Intestate Succession Act

- Tracking deceased estates

- Death of a spouse before divorce if finalised

Wills

- How to write a will.

- Example of a last will and testament.

- Get your will drafted for free (by a lawyer).

- List of lawyers that draft wills in Cape Town.

- Consider updating your will when these events occur:

- when divorcing; to avoid your ex-spouse possibly inheriting everything.

- death of somebody mentioned in your will,

- the birth of a child you may want to include in your will,

- marriages

Connect with a Deceased Estate Expert today

Deceased Estate discussion forum

Note that this is a public forum - exercise caution before acting on info and use at own risk. Anybody may ask and answer, and you don't know what their level of expertise is. No information on this website should be acted on without first consulting with a lawyer to test its validity. Do not share private details here.