"An Attorney near me" - Cape Town legal directory

lawyer@capetownlawyer.co.za or WhatsApp

An accrual claim is made by a divorcing spouse against the other for a portion of the increase in the other spouse's net worth during the marriage, in line with the methodology set out in the antenuptial contract. The increase (or decrease) in the joint net estate at the point of divorce over its value at the start of marriage (increased for inflation) is shared between the spouses (there may be some assets which are excluded from this calculation). To effect this, a transfer of assets is made from one spouse to the other.

Free ANC with Accrual template & example of divorce division of estate calculations

Click here to download the spreadsheet template for divorce from an antenuptial contract with accrual. The download contains an example of an accrual claim calculation; which you can overwrite and populate with the details of your and your spouse's assets and liabilities. We strongly recommend that it be emailed back to us at lawyer@capetownlawyer.co.za for a quick review and final approval; along with a copy of your antenuptial contract, so we can check that the accrual calculation is aligned with it; and no obvious mistakes have been made.

We've designed this template to aid divorcing couples in dividing their joint estate; if they were married with an antenuptial contract (ANC) with the applicatioin of the accrual principle (also known as a prenuptial agreement with the accrual principle) according to South African law. The template is shared on a use with own risk basis. We don't have the time (and more importantly, it would not be cost efficient for our clients) to fill in every asset and liability every divorcing couple has. We are happy to get involved once the template has been populated, to check that the mechanics of the calculation are being done correctly, in providing guidance on filling in the template and assisting with the valuation of privately held assets, deferred tax, the pension interest and helping reduce/eliminate property assets' transfer duty.

Accrual claim calculation example

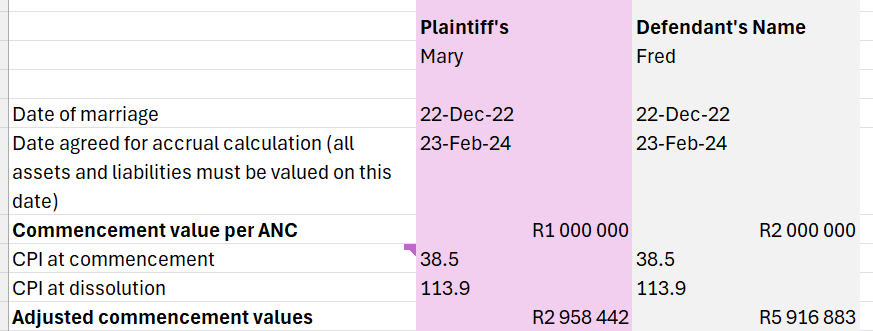

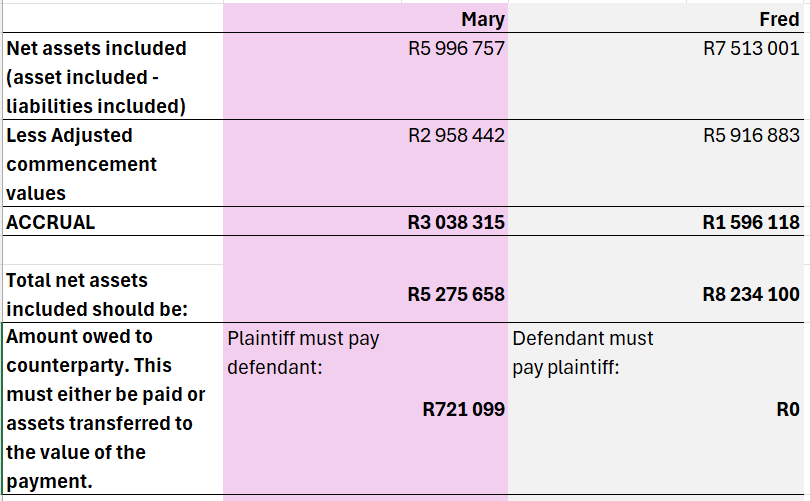

On the rest of this page we'll outline how the accrual calculation works and how to populate the spreadsheet. The example we use of the accrual claim calculation may be summarised as follows:

- Joint net Commencement values (increased with inflation) = R8 875 325

- Mary's commencement value = R2 958 442

- Fred's commencement value = R5 916 883

- Joint net estate at date of divorce = R13 509 758

- Accrual = Increase in joint net estate = R13 509 758 - R8 875 325 = R4 634 433

- Half the accrual = R2 317 217

- An asset transfer should occur from Fred to Mary so that:

- Mary ends with R2 958 442 + R2 317217 = R5 275 858

- Fred ends with R5 916 883 + R2 317217 = R8 234 100

- As per the ANC, Fred's gun collection and Mary's mother's diamond ring are excluded from the above.

How were you married?

As mentioned above, this calculation is only relevant if you were married with an ANC on the accrual basis. If you were married in community of property or ANC without accrual, there are different principles which apply.

Exclude Commencement values

Your ANC will specify commencement values (which could be zero) on the date you were married. These values, together with their growth at the rate of the consumer price index, are excluded for the purpose of the accrual calculation.

Other excluded assets

Other than the commencement values, there may be assets which are specifically listed as being excluded, in the antenuptial contract, and the following assets are typically excluded:

-

Assets received as gifts or inheritances during the marriage.

-

Compensation received for personal injuries (excluding damages for patrimonial loss).

- Donations made between spouses during the marriage.

List value of assets and liabilities

Every single asset and liability should be listed and added up (or subtracted in the case of liabilities), to calculate each spouse's net total assets and the total net estate. Remember to retain proof of where you got each number, and be sure that the value you obtained is for the correct agreed upon accrual calculation date.

The valuation of assets such as private businesses requires specific investment valuations expertise, ,and there is a degree of subjectivity to them. Email lawyer@capetownlawyer.co.za if you need assistance with the valuation of companies held privately.

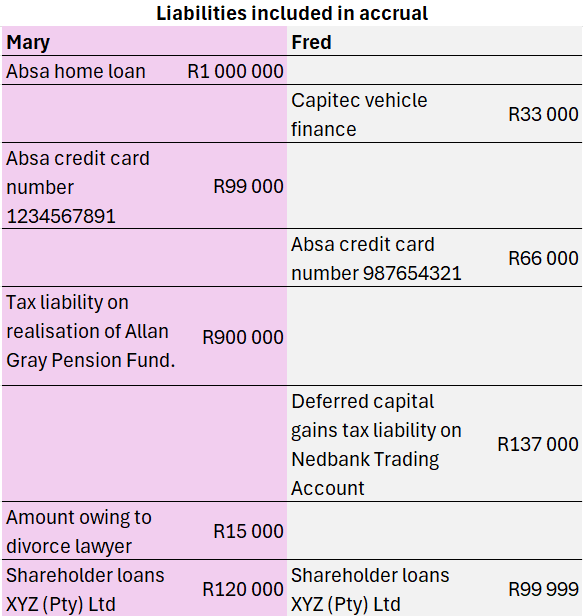

Here's an example of a list of liabilities:

Gross or net of tax

A key decision the parties should attempt to agree on is whether the joint estate will be caculated on a gross or net of tax basis. If gross of tax the calculation is far simpler; if net of tax the calculation is more complex, but arguably fairer. See article on pension interest and tax to get an idea of the complexities involved.

Forgetting about the legalities of the situation for a moment, let's explore the advantages and disadvantages of using a gross of tax approach:- Advantages of gross of tax approach:

- Valuing assets on a gross of tax basis is easier:

- As it involves estimating the market value without consideration for tax.

- Asset values net of tax are only known with certainty after a sale has been made and SARS has accepted the tax payment as being correct.

- It avoids having to make subjective assumptions about:

- timing of disposals.

- tax rates of the two spouses at the time of disposal, which depend inter alia on future income; and there is also the possibility of future changes in SARS's tax rates, brackets and methods.

- It avoids potential inopportune forced sales of assets so as to assess/demonstrate the tax which will be payable.

- The gross value of the assets does not depend on who gets the asset post the divorce. The rate of taxation on the proceeds of pension fund savings, may be different in the hands of the husband to the wife.

- Less work for valuations experts; thus costing less to estimate asset values.

- Not having to factor in potential future tax liabilities, can simplify negotiations, saving time and legal costs (whilst it's still possible that the gross value of assets is disputed, there wont be a dispute over the tax estimates).

- If the parties both have very low or zero rates of taxation, then it may not make a big difference to the result whether a gross or net of tax approach is followed (note that for some types of assets the tax rate may not depend on marginal income tax rates).

- It's not completely clear how tax assets, assessed tax losses and assessed tax refunds are to be treated under a gross of tax approach.

- Valuing assets on a gross of tax basis is easier:

- Disadvantages of gross of tax approach:

- Eventually the asset will need to be sold, whether as part of a divorce order or further down the line when money is needed, and the associated tax will have to be paid to the Revenue Service.

- This will leave whichever party had to realise the asset with a shortfall (possibly unanticipated if the gross of tax approach wasn't an informed decision).

- Valuing the joint estate on a gross of tax basis would disadvantage whichever party has the highest associated tax liabilities.

- Usually this is the party with more assets in his/her name.

- But the different taxes and rates applicable to different types of assets also plays a role; and the tax applicable does not always depend on marginal income tax rates.

- As does the level of unrealised capital gains within each asset.

- Eventually the asset will need to be sold, whether as part of a divorce order or further down the line when money is needed, and the associated tax will have to be paid to the Revenue Service.

Cost of sales

Similarly to tax; one needs to consider other costs involved in selling assets; e.g. property transfer costs (conveyancing costs, etc...).

Divorce accrual

The total net estate less the grown commencement values constitutes the divorce accrual, which is divided up between the 2 parties.

Moving assets between parties

One party usually ends up with a surplus of assets, and needs to transfer assets to the other party. The spouses will ideally reach an agreement on what the assets to be transferred are, and attempt to do it in a tax efficient manner, to this end it's critical to get the paperwork right so that:

- transfer of ownership of any fixed property from husband to wife (or vice versa) does not result in transfer duties.

- transfers of pension fund assets can occur unhindered.

Family, Estate & notarial legal services

Frequently asked questions

- What is the ANC accrual calculation formula/equation?

- Accrual = (End Value )- (Adjusted Commencement Value)

- End value = the sum of the net values of each spouse's estate at the dissolution of the marriage. Assets excluded by the ANC or through inheritance, donations, or personal injury awards during the marriage are not included.

- Adjusted Commencement Value = (Commencement Value) * (CPI at Dissolution / CPI at Commencement)

- Commencement values = the net value of each spouse's estate at the beginning of the marriage, as specified in the antenuptial contract.

- CPI = South Africa's Consumer Price Index

- Accrual = (End Value )- (Adjusted Commencement Value)

- What is the ANC accrual claim formula?

- Accrual Claim = (Larger Accrual - Smaller Accrual) / 2

- The spouse with a smaller accrual is entitled to claim this amount from the spouse with the larger accrual.

- Accrual Claim = (Larger Accrual - Smaller Accrual) / 2

- Where can I get hold of the antenuptial contract we signed when getting married?

- The Deeds Office in the city it was lodged. should have your Antenuptial contract. You can do a search with www.mydeedsearch.co.za

Ending an ANC with Accrual marriage

Free Antenuptial contract with accrual spreadsheet template for the division of the joint estate.

- Division of the joint estate for ANC with accrual divorce.

- When parties cannot agree on the accrual calculation; the court may appointment a referee to assist with the accrual calculation

- When parties cannot decide how to divvy the assets : The court may nominate someone to collect, realise and divide the estate (called a liquidator, receiver or curator).

- The duty to disclose your financials when divorcing:

- Insufficent disclosure from a spouse on their assets/liabilities; the section 7 notice remedy (in terms of the Matrimonial Property Act) .

- Divorce full disclosure clause

- Example of ANC with accrual marriage contract.

- Property

- Donation of property agreement not followed through.

- When property is erroneously in your spouse's name.

- Conveyancers conduct the transfer of property ownership from one spouse to another (or to a third party, if relevant).

- Divorce settlement clauses

- Enforceability of antenuptial contract overseas

- Amending an antenuptial contract

- Postnuptial contract - for when you're already married and realise you should have entered into an antenuptial contract, or you want to amend an existing agreement.

- Marriage

ANC with Accrual discussion forum

Note that this is a public forum - exercise caution before acting on info and use at own risk. Anybody may ask and answer, and you don't know what their level of expertise is. No information on this website should be acted on without first consulting with an experienced attorney to test its validity. Do not share private details here.