Report a Deceased Estate to the Master Online

These days not only is it easy to track a deceased estate online, but you can also register/report the deceased estate online. Here's a step by step guide making the process easy for you. If you'd like more assistance including that of executorship of the estate by an attorney, email lawyer@capetownlawyer.co.za.

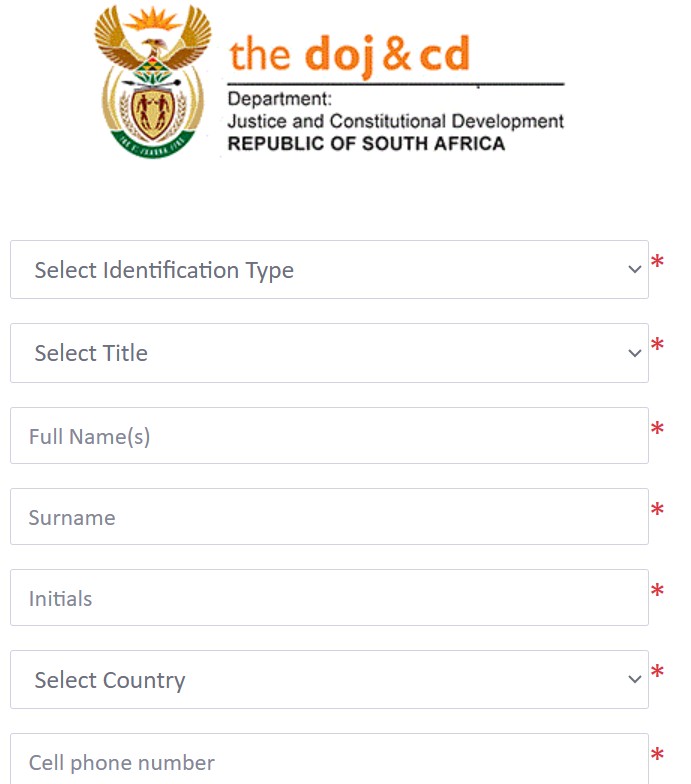

Step 1: Register as a User

Click here to navigate to the registration page. You'll need to provide the following information:

- Identification type (South African ID number as per your ID book; or passport number - the passport option is if you are not South African)

- Title (e.g. Mr. or Mrs.)

- Full Names

- Surname

- Initials

- Country

- Cell number (you will need access to the phone number to verify this)

- Email Address (optional, can be personal email or work email)

- Password

You'll then need to verify your cellphone number and email address (check your spam box if you can't find the email). You wont be allowed to report a deceased estate until you have also added your residential address; which is utilised for your jurisdiction.

Family, Estate & notarial legal services

Step 2: Register a new death notice/application

- Click here to navigate to the page to register a new death notice/application.

- Then click on the menu item "Master of the High Court Services".

- Then click on "Deceased Estates"

- Then click on "Register a New Death Notice/Application"

Register a New Death Notice/Application

You'll need to make a "Deceased Estate Application Declaration"; once you have clicked on the hyperlink taking you here, you'll be taken to a page which shows you the information you'd require to process the application; you'll need to confirm the following:

-

Do you have all the information required to lodge the Estate?

-

Do you have all required documents to complete the process?

-

Is an executor nominated?

You will need to attach the following documents:

- Deceased Death Cerificate;

- Deceased ID/Passport Document;

- Applicant ID/Passport Document;

- Next of Kin ID/Passport documents(s);

- Deceased Marriage Cerificate;

- Will/Testament.

- J155 - Undertaking and Acceptance of Masters Directions;

- J190 - Acceptance of Trust as Executor;

- J 192 - Affidavit Particualrs of Next of Kin must be commissioned and signed;

- J294 - Death Notice;

- Nomination of Masters Representatives / Executor;

- J243 - Inventory - Signed copy

Deceased Details

- RSA Identity Number (13 Digits Number)

- Live Status (alive or deceased)

- Nationality

- Full Name(s)

- Surname

- Maiden Surname

- Place of Birth

- Population Group

- Occupation

- Date Of Birth

- Marital Status

- Divorced

- Life Partnersip

- Single

- Married

- Widow

- Widower

- Marriage type

- Customary marriage

- Jewish

- Married in Community of Property

- Married Out of Community of Property

- Married Out of Community of Property with accrual

- Muslim/Hindu

- Permanent life partner

- Place Where Married

- Date Of Death

- Will Available: (Yes/No)

- Upload will if available

Next sections

Once the above personal details have been completed, the system will allow you to progress to completing the following sections:

- Applicant information

- Next of kin details

- Assets and liabilities

- Executor information

- Supporting documents

Estate online reporting user guide

Click here to download the deceased estate online reporting user guide.

Training webinar

Cost of reporting a deceased estate

There is no upfront fee payable when you report a deceased estate; the minimal reporting fee (if any) is paid later by the estate. At the time of writing the reporting fee was R250 if an estate had a gross value greater than R250,000; otherwise there was no reporting fee on estates with a gross value of less than R250,000. Whilst the reporting fee itself si minimal, there are more significant fees which may incurred by the deceased estate:

- Executor fees

- Legal fees

- Master's fees

- Tax

- Advertising costs

- Valuation charges

- Transfer costs on property inherited

- Bank fees

- Other costs which the estate may incur

Deceased Estate Information

If a relative has died, perhaps without a will, and you are unsure of what do:

- Report deceased estate to the Master online

- Steps to take when your parent dies without a will.

- Lawyers in Cape Town specialising in deceased estates.

- Administrators in Cape Town for deceased estates .

- Letter of executorship requirements in South Africa.

- J192 form - next-of-kin (if no will)

- Nomination to act as executor (if no will)

- J190 form assistance

- Administration of deceased estates in South Africa.

- Property transfer cost in a deceased estate.

- Inheritance and child maintenance obligations.

- Intestate Succession Act

- Tracking deceased estates

- Death of a spouse before divorce if finalised

Wills

- How to write a will.

- Example of a last will and testament.

- Get your will drafted for free (by a lawyer).

- List of lawyers that draft wills in Cape Town.

- Consider updating your will when these events occur:

- when divorcing; to avoid your ex-spouse possibly inheriting everything.

- death of somebody mentioned in your will,

- the birth of a child you may want to include in your will,

- marriages

Connect with a Deceased Estate Expert today

Deceased Estate discussion forum

Note that this is a public forum - exercise caution before acting on info and use at own risk. Anybody may ask and answer, and you don't know what their level of expertise is. No information on this website should be acted on without first consulting with a lawyer to test its validity. Do not share private details here.